18 April, 2024

BMLL Market Lens: European Liquidity Maps

BMLL Market Lens: European Liquidity Maps provides insight into the fragmentation of European equity markets via a view of all Cboe Europe All Companies index constituents across the major European trading and execution venues over a 12-month period.Read more

11 April, 2024

Aggregated metrics to better understand the market

A selection of 7 aggregated metrics to better understand the market, including Volatility, TWA Spread, Quote to Trade, Mean Resting Time, Notional Liquidity Around BBO, Fill Probability and Auction Dislocation.Read more

4 April, 2024

View From The Feed - Futures

Using BMLL’s granular Level 3 Data, explore the micro-structure for a variety of future assets. The metrics used to describe the market state include Liquidity, Volatility, Iceberg order (CME produce only), and more. You can access the full picture of an individual future product, in a six month time span.Read more

3 April, 2024

€STR Wars: Attack of the Clones Part 2

As €STR continues to grow and gain market share, understanding the liquidity profile of competing €STR futures on ICE, CME and Eurex will be critical for market participants to trade better.This article identifies the trends in trading volume for €STR futures in Q1 2024.

Read more

28 March, 2024

BMLL Market Lens: US Liquidity Maps

BMLL Market Lens: US Liquidity Maps provide insight into the US equity markets with a view of the top 500 US stocks across the major trading and execution venues over a 13-month period.Read more

20 March, 2024

Mind the Gap: Should you buy historical data from a real time data vendor?

In this article, Ben Collins, our Head of Sales (EMEA & APAC), explains why firms no longer need to compromise on a lower-quality historical data service with incomplete data.Read more

14 March, 2024

Aggregated metrics to better understand the market March24

A selection of 7 aggregated metrics to better understand the market, including Volatility, TWA Spread, Quote to Trade, Mean Resting Time, Notional Liquidity Around BBO, Fill Probability and Auction Dislocation.Read more

22 February, 2024

2023: Global Equity Trading Retrospective

Looking back over the past year in equity trading, it’s easy to forget the scale of transformations that took place. Whether it was volatility due to bank runs, federal reserve interest rate changes, or continued rise of ETFs, understanding the equity trading landscape has continued to be critical to all market participants. This blog examines volume trends between the US and Europe using BMLL Level 3 Data insights.Read more

2 February, 2024

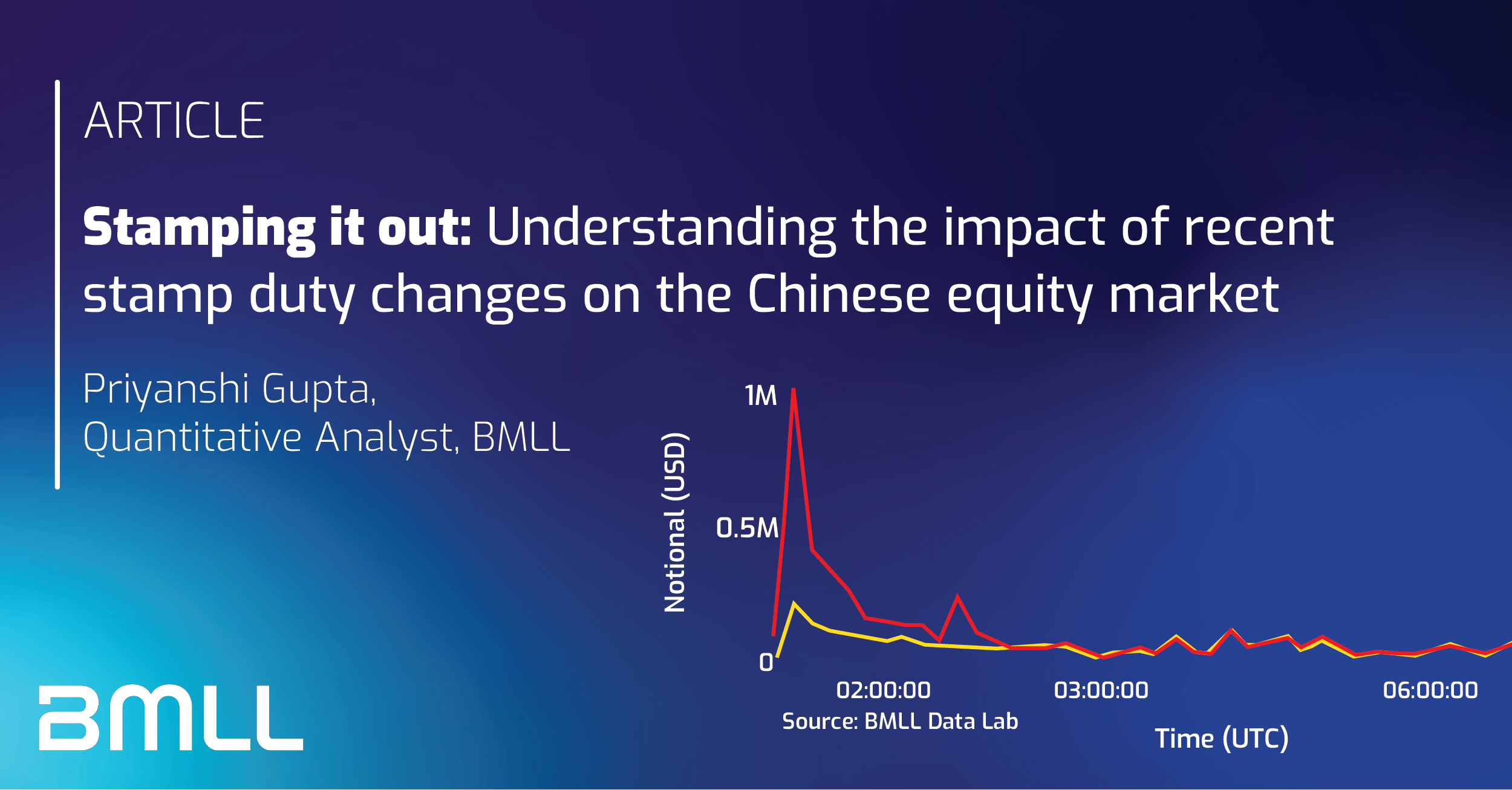

Stamping it out: Understanding the impact of recent stamp duty changes on the Chinese equity market

This article explores how the recent reduction in stamp duty in China has affected market behaviour.Read more