First published in Tabb Forum, June 2021

While the industry awaits the result of the FCA consultation on the permanent removal of RTS 27 and RTS 28 -- rules for monitoring best execution for equities, the direction of travel seems clear. So what is next for the trading community? Is this a setback, or an opportunity? In this article, Masami Johnstone, Senior Client Advisor at BMLL Technologies, looks into these questions and offers her analysis.

Recent regulatory decisions to end best execution monitoring in the form of RTS 27 and RTS 28 - for 2021 in the first instance, has profound implications for the capital markets industry’s long-standing goal for market transparency. Although unloved, these regulatory requirements are founded on a good intention - to carry out best execution monitoring and address the need to understand the increasingly complex market structure in Europe. RTS 27 was created to collate details from trading venues and Systematic Internalisers (SIs) to construct a complete picture of the market. At the same time, RTS 28 reporting allowed the buy-side an opportunity to take more control of venue selection as a part of best execution monitoring.

While we await the result of the FCA consultation on the permanent removal of RTS 27 and RTS 28, the direction of travel seems clear. So what next for the trading community? Is this a setback, or an opportunity?

In the beginning, there was TCA. But is it enough today?

Although a reversal in RTS 27 and RTS 28 seems to be on the cards, we have seen significant progress in best execution monitoring since the inception of TCA. The initial concept of TCA goes back more than 30 years to a time when in the investment industry needed to maximise investment returns by controlling trading cost. However, when this concept first emerged, electronic trading was non-existent; therefore, the market structure complexity we face today didn’t exist.

Over the years, TCA steadily evolved along with changes in market structure and became a useful tool for best execution monitoring. The number of available TCA benchmarks to track trading cost increased, and its reporting capability enhanced significantly. For example, using both Level 1 and Level 2 venue data TCA can now provide users with insight into how much volume they captured at different venues and at what speed. These improvements are significant for the buy-side to understand the impact of fragmentation in the European markets for their investment strategies.

TCA vs Execution Analysis

Given the evolution of the market, we have to evaluate if TCA - in its current form - is still sufficient. One thing is clear - the buy-side’s desire to understand their broker’s order routing strategy fully remains vital. As European markets continue to fragment and new trading tools/methods emerge, this long-standing crusade is gaining momentum.

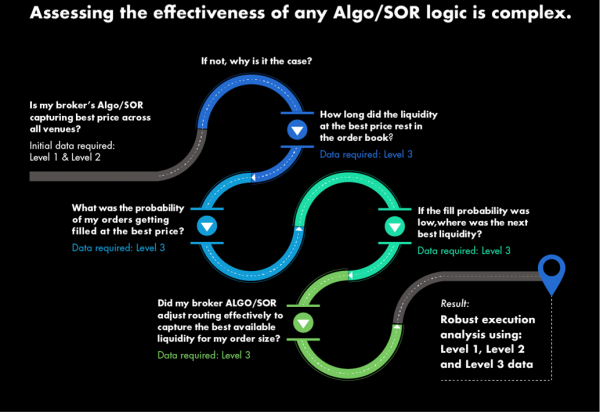

A seemingly simple question such as “Is my broker Algo capturing best liquidity?” is still very complicated to answer. Because, in order to fully assess any order routing logic and evaluate the quality of liquidity, the most granular data, Level 3, is required, in a harmonised manner across all venues. This is not an easy task. It requires rigorous data point normalisation and harmonisation of each venue’s unique flags, and data scientists know this involves a non-trivial amount of data engineering.

If we take, for example, VODAFONE GROUP PLC, we can see that the stock trades across five Lit venues and five Dark venues. On top of these venues, the stock also trades on multiple bi-lateral platforms, including SIs and other non-addressable markets. In addition to the fragmented market volume, the challenge is that their price and liquidity are also intricately linked as Algos and SORs sweep through these venues to capture available liquidity.

Robust execution analysis is needed more than ever, from metrics that only Level 3 data can provide, in order to reverse-engineer this complex order routing landscape and assess the effectiveness of any routing logic.

Execution Analysis is here to stay

This is why asking a seemingly straightforward question such as: “is my broker’s Algo/SOR capturing the best price across all venues?” is not that easy to answer. In fact, this is not something we can fully answer with traditional TCA that uses only Level 1 and Level 2 data.

And here’s why:

We need to examine the details of the available liquidity at each venue that the router swept through and the context of “accessible” liquidity for execution. How long was the particular liquidity resting at the best price on this specific venue? Was it accessible to you? What was the probability of my orders getting filled at the best price? Those questions can only be answered if we have access to the full depth of the order book at trading venues.

Metrics such as the EBBO Mean Resting Time within Level 3 data can allow us to see how passive orders behave for a particular instrument. Fill Probability metrics will also provide additional insight into the effectiveness of SOR adjustment if certain liquidity tends to disappear quickly.

And when it comes to closing auctions - which have become increasingly popular - the Close Algo, for example, can leverage additional insight from Level 3 auction metrics such as Auction Dislocation and Auction Imbalance. These metrics provide the information for order interaction during the auction period – invaluable insights into the

trading venue’s auction matching mechanism. Execution analysis at this scale is what the buy-side needs to understand the effectiveness of their broker Algo and SOR.

Opportunities ahead

With or without RTS 27 and RTS 28, the reason for their existence continues; the need to construct a continuous view of the entire market and take more control of venue selection remains strong and the desire for robust execution monitoring is here to stay. And for this reason, not just the ability to access more granular data but also having the tools to carry out data driven execution analysis remain important. Industry participants demand greater and crucially actionable insight into the effectiveness of Algos and SORs in order to drive performance and to better serve the interests of the end investor.

Level 3 data plays a crucial role in this process and is increasingly available to the buy-side community. And those who do not have access to it yet, are looking to change that. A recent whitepaper entitled “Buy-side usage of Level 3 data analytics for algorithmic performance” found that 74% of respondents use Level 3 data to improve alpha generation and mitigate risk. What’s more, 64% of respondents said that at least 50% of their investment in new data and analytics capabilities will be from buying-in these capabilities.

Only Level 3 data, that is harmonised across multiple venues, allows market participants to examine order routing strategy using the full depth of the venue order book. These insights will subsequently enable both the buy-side and the sell-side to improve their dialogue and effectively assess Algo/SOR logic and effectiveness together.

The potential future removal of RTS 27 and RTS 28 should not be a setback for the trading community. Instead, this change should allow both the buy-side and sell-side an opportunity to embrace the data and technology available to enhance their execution analysis capability.

The time for robust execution analysis in Europe is now.

Masami Johnston

Senior Client Advisor, BMLL Technologies