In the end, the high drama came down to penalties on Sunday night. This week, as Italy celebrates and England recuperates from the finals of the Euro 2020 Football Championships, there are correlations to be made to the world of finance. In this article, Will Dean, Quantitative Analyst at BMLL Technologies, considers the impact winning or losing football matches has on the capital markets.

It was hard to tell if the heaviness in England on Monday morning was the disappointment or the hangover as the English football fever broke into the cold sweats of knowing that Baddiel, Skinner and The Lightning Seeds need to update their “30 Years of Hurt” to 56 years of hurt at least. With those fans then heading into work, the impacts are, predictably, far reaching. Here we investigate if the effects can be seen in the capital markets.

On Monday, activity on the London Stock Exchange was down 8.6% against baseline and Tuesday saw activity 9.7% down. The victors in Italy were even more distracted with a 14.6% and 19.0% drop on Monday and Tuesday since last week respectively. The Italian markets had such high sentiment that they saw a 1.3% rise in prices on Monday compared to last week. One possible conclusion is that: some UK and Italian participants brought their respective emotions from Sunday into work and were thinking about football rather than their trading. BMLL investigates whether this is coincidence or if this result is consistent with historical data.

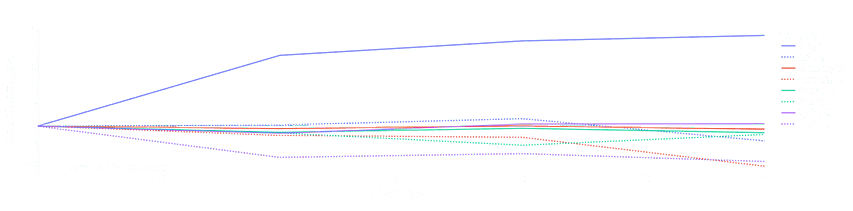

We looked at all games played between January 1, 2018 and July 13, 2021 and considered the average market return of symbols listed on the national exchanges following football games for the national team weighted by the game importance[1] and split further by the result of that game to determine if football can drive sufficient market sentiment to move the market. For Spain, Italy, Germany and France the market returns are measurably stronger after the national team wins. The Italian markets respond to winning with a nearly 5bps rise in equity prices and a static market after losses; this pessimistic market sentiment defies the evidence of an Italian team having lost only 3 of their last 41 games. In the opposite direction, the Spanish and German markets take ~2.5bps from their prices after losses with no change after wins; the German market pricing in a win belies a team having won only 40.0% of their games since 2017.

Exhibit 1: Market returns per day after teams have won or lost a football match, start 2018 – present

Despite the much discussed football fever that hits the nation biannually, England joins The Netherlands as the only countries considered here that do not demonstrate football success results with market returns. Whilst not moving prices, football matches impact the markets by reducing activity; we see the number of inserts into the book decrease for every country the following day regardless of the game’s result. Whilst a lot of speculation exists on the market impact related to hangovers, people calling out of work entirely, or simple fatigue, we are not able to determine this effect from the order book data.

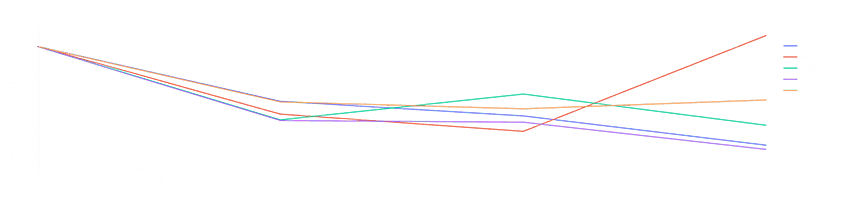

Exhibit 2: Market activity per day after winning a football match, start 2018 – present

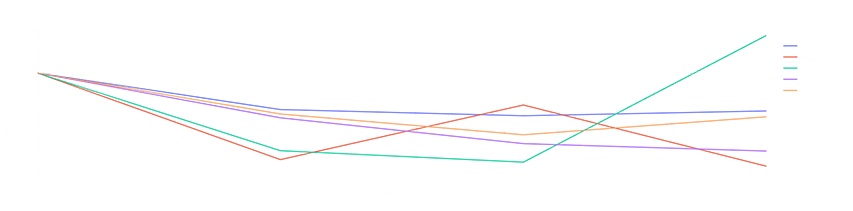

The biggest single dip in trading activity is The Netherlands commiserating losses with a 6.0% reduction in quoting, whilst the celebrations following a Dutch win only lead to a 2.2% reduction in trading activity. Interestingly, German trading activity recovers within a day after a win, but it appears to take the German markets 2 days to bottom out after their losses. Following wins, English, German and French market activities recover within 24 hours whilst the Italian and Dutch markets take two days to fully enjoy their celebrations.

As the nation begins to heal and returns its focus to the capital markets, we can be confident that as the footballing world turns its eye to Qatar 2022, attention will move away from trading again until it returns and the results may move prices.

Exhibit 3: Market activity per day after losing a football match, start 2018 – present

Conclusions

- Prices in the Italian markets climb 5bps after wins and don’t move on football losses, the markets haven’t priced in the win despite Italy having lost only 3 of their last 41 games.

- The German markets price in wins and fall on losses, surprising given the national team has struggled of late, winning only 40% of their last 43 games.

- The Dutch markets commiserate their losses far more heavily than they celebrate their wins: a 2.2% reduction in activity follows wins but 6.0% after their losses.

- Markets other than The Netherlands and Germany see a bigger reduction in activity following wins rather than losses, whilst The Netherlands and Germany commiserate their losses more than they celebrate their wins.

- The Italian and Dutch markets celebrate wins over two days, with larger reductions on the second day, whilst everyone else is heading back to business after one day.

- Everyone apart from The Netherlands takes two days of reduced activity after losses. The Netherlands stoically return to the task after just one night.

[1] Friendlies as 1, Tournament qualifying as 2, Group Stages as 3, Knock-Out matches as 4 and major finals as 5. A bump of 0.5 was given to any game played against a major rival.

Will Dean

Quantitative Analyst, BMLL Technologies