Market Lens #2

The Question: Is the growth trend in closing auction volume share linear, or is it affected by other market conditions?

The Answer: The data suggests, in periods of higher volatility, market participants’ order behaviour changes and affects their use of the closing auction. During these periods, rather than trading on the close to target closing benchmarks, they might consider shifting trading to continuous to achieve a better execution outcome.

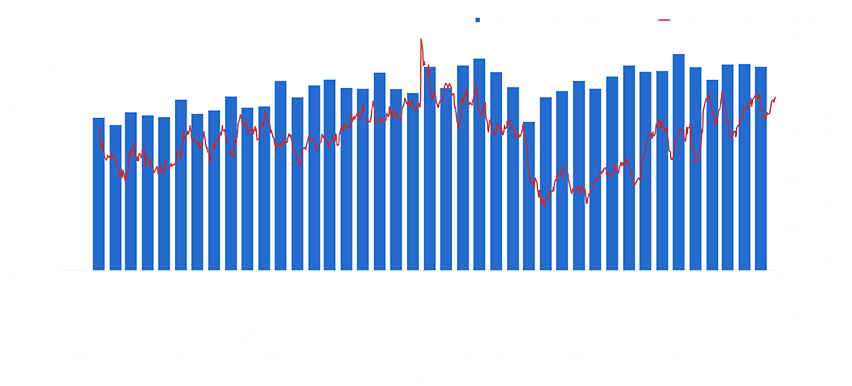

Exhibit 1: Percentage of execution in closing auctions on all LSEG listed stocks versus mean resting time of orders

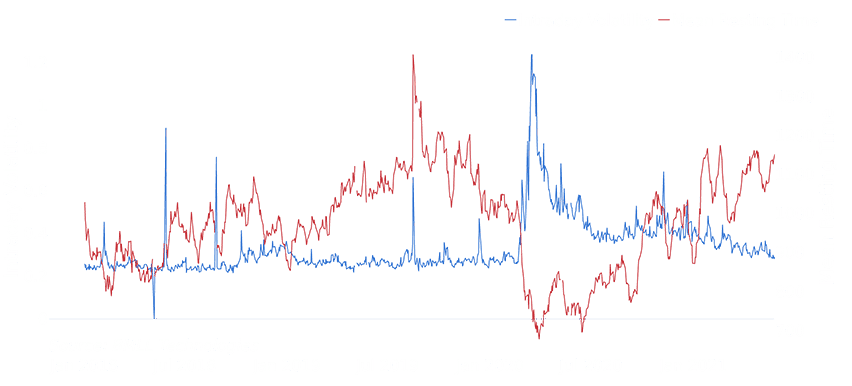

Exhibit 2: Intraday Volatility and Mean Resting Time on all LSEG listed stocks

Since January 2018, the share of volume traded in the closing auction on the London Stock Exchange compared to the volume in lit continuous trading has consistently grown from around 30% to nearly 40%. Market participants may conclude that this is an effect of best execution compliance driving liquidity into the auction. However, it might be argued that other market conditions affect this increase in closing auction volume share.

Looking at volatility levels and the length of time orders are resting on the order book, the data suggests that there is a relationship between volatility, order resting time and closing auction volume share. As volatility increases, order resting time decreases and we see the closing auction volume share go down. This suggests there is a change in behaviour when trading strategies adjust to an increase in volatility. At the height of volatility, market participants need to assess whether they should wait for the closing auction or execute their orders during the continuous trading sessions.

Conversely, as markets become more stable with lower volatility, market participants can afford to wait until the close to get filled on their trades in order to provide best execution.

The Context: This was observed between Jan 2018 and Feb 2020 where closing auction volume share increased. In March 2020 the market experienced extreme intraday volatility under the threat of the pandemic. Exhibit 1 indicates that during March 2020 closing auction volume share fell, while higher volatility triggered lower order resting times as market participants reacted to the unpredictable market conditions. As the pandemic fears subsided in the market, intraday volatility has fallen, mean order resting times increased and auction share has risen - although they have not yet returned to their pre-pandemic levels.

The So What: This analysis suggests that, during periods of market stress, market participants do not necessarily turn to the closing auction for their executions. Using Level 3 metrics, such as mean order resting times, market participants can gain additional insight to make more informed execution decisions to improve performance.

More Market Lens articles

Insight #1 : Double Volume Cap – what is happening below the surface?