Market Lens #1

The Question: What is the impact of the Double Volume Cap (DVC) removal on dark venue share of trading?

The Answer: We observe that since the beginning of the year, the Dark trading volume share of EU stocks trading increased on UK venues, but it remained unchanged on EU venues where trading volumes were significantly (145x) higher. Whilst, it may be surprising EU stocks trade on UK markets, it's even more surprising they trade so differently than on the EU venues. Is the increase on UK venues attributable to the Dark Double Volume Cap removal in the UK? Probably not - the answer may lie in the deteriorating condition on Lit venues.

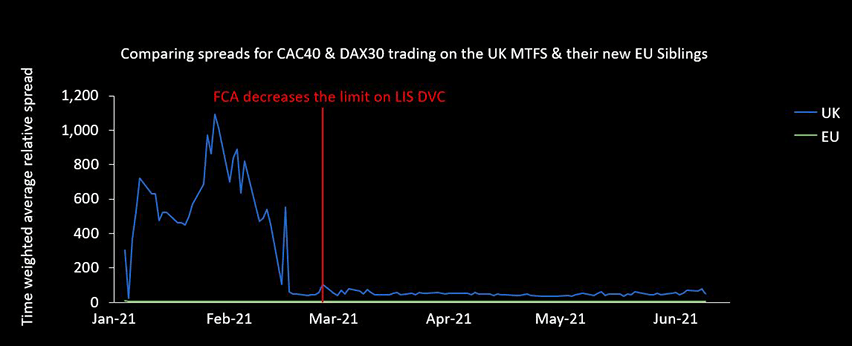

We also examined the average spread for Lit venues during the same period. It appears that the volume shift to the UK Dark venues coincided with widening spread on Lit venues, in particular, January to mid-March this year. Since spreads have settled down on Lit venues, the fraction moving to the Dark has also stabilised.

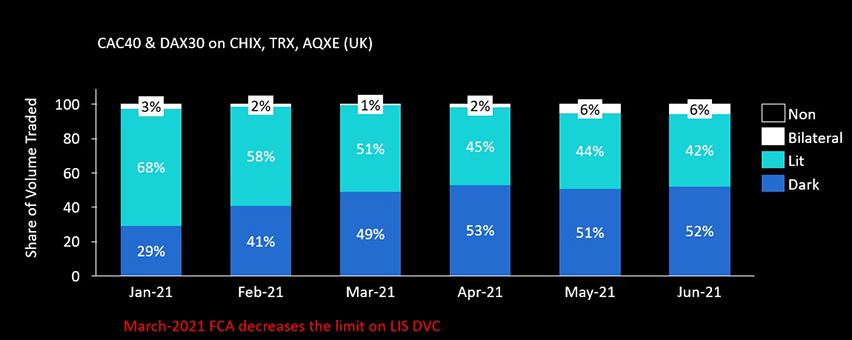

Exhibit 1 - Market Share Breakdown - UK Venues by Liquidity Classification

Exhibit 2 - Lit venues average spread for UK MTFs & EU

The Context: The UK Financial Conduct Authority recently decided to lower the Large-in-Scale (LIS) thresholds for Dark Pool trading substantially to €15,000. This is a notable decline compared to the minimum threshold of €650,000 imposed by the EU.

The Methodology: Based on the stocks in CAC40 & DAX30 traded on CHIX, CEUX, TRQX, TQEX, AQXE and AQEU, we examined the change in market fragmentation across Lit, Dark, Bi-lateral (i.e. SI/ELP) and Non-addressable venues. It is worth noting that during the period in question, EU Dark venues traded 145x more volume than the corresponding UK venues for the same securities.

The So What?

The trading landscape continues to evolve in Europe and the UK with potential reversal of the existing regulations. Market participants need to be vigilant for any sudden change in order book interaction, especially when underlying conditions are changing below the order book surface. Using the most granular Level 3 data we can all keep our vigil until the markets find their equilibrium again.

Footnote: Insights provided by BMLL Data Lab - delivering granular level 3 order book data to the capital markets.

More Market Lens articles

Insight #2 : Closing Auction Volumes - what affects closing auction volume share?