INSIDE THE SIP AND THE MICROSTRUCTURE OF ODD-LOT QUOTES

Dr Elliot Banks, Chief Product Officer, BMLL

First published in Tabb Forum, April 2022

Understanding regulatory change across an already complex market structure is critically important for all market participants. Recent SEC proposals will have a significant impact on how some of the largest and most liquid stocks will trade in the future. This article examines the potential impact through the use of Level 3 market data, which provides deep and important insights into the way markets and specific securities are trading across venues.

Round vs odd lots

Equity markets in the US are fragmented across 16 so-called ‘lit’ exchanges, meaning limit orders are visible on a limit order book. The number of lit venues has increased over time, including the addition in September 2020 of three new lit exchanges - the Long-Term Stock Exchange (LTSE), Members Exchange (MEMX) and Miami Pearl (MIAX PEARL). In addition to lit trading, there are also dark pools in which trades can be made without pre-trade transparency. These include SEC-regulated alternative trading systems (ATS), internalised broker-dealer flow, and traditional over-the-counter (OTC) trading.

On top of this structure sits the Securities Information Processor (SIP), which processes all protected bid/ask quotes and trades from every trading venue into a consolidated tape, thereby providing the National Best Bid and Offer (NBBO). The NBBO is used by a large proportion of the trading community, and is also built into pricing of some dark trading mechanisms. It is important to note that NBBO prices are based on round lots only. A round lot is a number of shares grouped together, usually in groups of 100 shares. Historically, this was used by institutions to make it easier for them dealing in larger sizes. An odd lot is anything less than 100 shares, which was more typically used by the retail trade.

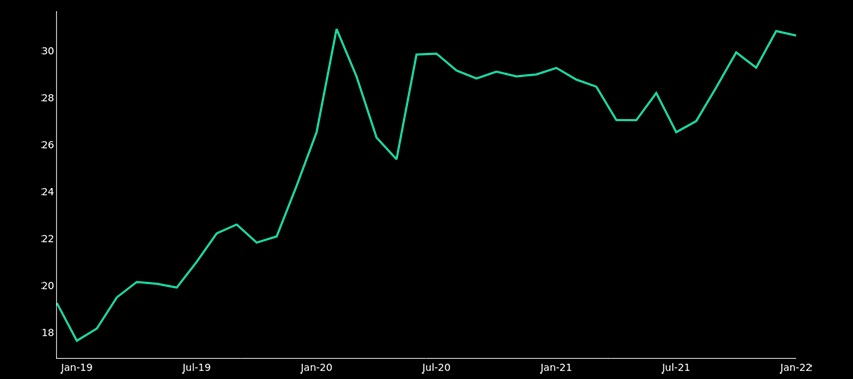

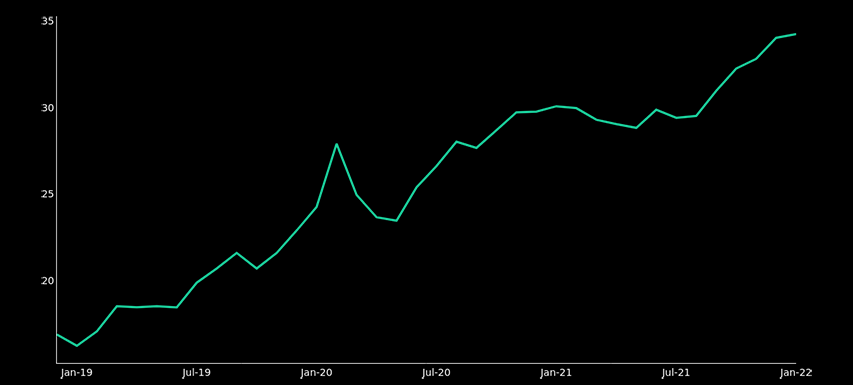

Odd-lot trading has increased in the last few years, as you can see in Fig 1. This is due to both electronification, where orders are broken into smaller “child” orders, and the high prices of some of the most liquid US stocks relative to their tick size. A round lot of an Amazon share, for example, costs over $300,000, whereas the tick size is only 1 cent.

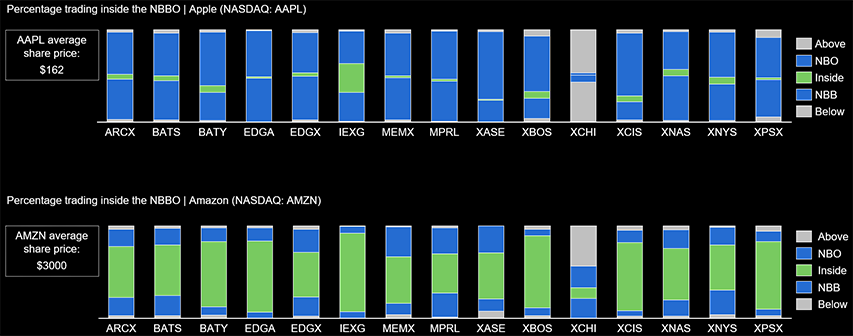

What is key to note is that odd lots trading inside the NBBO depends on whether the stock is ‘tick constrained’. Stocks like Apple are considered ‘tick-constrained’, meaning the spread equals one tick most of the time. As such, there is not much liquidity inside the NBBO, since it is nearly always one tick. Stocks like Amazon, on the other hand, are not ‘tick-constrained’, meaning the spreads are wider than a single tick, and there can be price levels with the NBBO.

Fig. 1.1: Trading percentage inside the NBBO by notional

Fig. 1.2: Trading percentage inside the NBBO by count

For these liquid, non-’tick-constrained’ stocks, there can be multiple price levels inside the NBBO. This presents an opportunity. By trading using full-depth exchange data, rather than the NBBO data, you can potentially achieve price improvement by trading inside the NBBO. This will vary per stock, depending on the price, liquidity and tick size. For example, see the comparison for Apple and Amazon in Fig 2. To understand this requires a full-depth view of every exchange.

Fig. 2: NBBO by venue

SEC round lot rule changes

Last year, the SEC finalised various modifications to the Regulation National Market System (Reg NMS).[1] The change looks to address the “information asymmetry” representing the difference between the data available on the SIP and that available from other proprietary sources.

Essentially the rule change is a recalibration of the number of shares that constitutes a round lot, placing higher-priced stocks into various buckets with fewer shares constituting a round lot. In addition, a tighter definition of “core data” will now include the aggregation of odd lots when the total number of shares is equal to or exceeds the round lot definition for that security. The changes will be phased in subject to a number of dependencies and the readiness of the providers, but is expected to be over a quite extended period of time.

By using the BMLL Data Lab, we can examine the potential impact of the SEC rule changes. In real dollar terms, up to 30% of the S&P 500 will be shifted into different bands. By looking at a typical day of trading Amazon shares, we found the change in price difference under the new rules could lead to an NBBO price difference of up to 3-4 basis points.

Replay and rebuild to achieve insight

Market participants need to understand how ~SEC rule changes~ will alter not only individual stocks, but how they will be affected at different times a day, across different markets. It is only with access to Level 3 order book data that the impact of these changes to liquidity, best execution and market quality can be fully understood.

[1] Final Rule: Market Data Infrastructure - SEC.gov: https://www.sec.gov/rules/final/2020/34-90610.pdf

Read this article on Tabb Forum