The LIBOR to SOFR transition: managing best execution for futures trading

One of the most important topics in the financial markets is the transition from the London Inter-Bank Offered Rate (LIBOR) to risk-free rates, such as the Secured Overnight Financing Rate (SOFR). The transition of critical benchmark rates has wide-ranging implications across the capital markets in terms of product structure, risk management and hedging strategies. In addition to the structural impacts of the transition, the profile of the product migration has significant impacts on liquidity – a key component in risk transfer.

One of the key instruments in the interest rate markets is the futures market, which are used for hedging, risk management and as a source of generating alpha. So for interest rate futures, understanding the impact the LIBOR transition has had on liquidity and market microstructure is critical for best execution considerations and to optimise trading and hedging strategies.

The clearly stated policy of the UK’s Financial Conduct Authority (FCA) has been to migrate away from LIBOR as a benchmark underlying. For the US dollar this has meant a migration to the SOFR rate. There is a firm cessation date in June 2023, when all remaining LIBOR will move to SOFR. While the transition was clearly defined from a rate perspective (and was clearly seen in the interest rate swaps market), it was less clear when and how the transition would occur in interest rate futures.

To understand the implications of the LIBOR to SOFR transition and what it means for trading and hedging strategies, we need to fully analyse interest rate spread futures. To perform this analysis, we’ve dug into Level 3 Order Book data on the CME, and looked at two different ways the LIBOR transition has been seen in the futures markets.

#1: The uneven transition of liquidity from Eurodollar to SOFR futures

The Eurodollar futures complex is one of the most widely traded futures contracts globally, supporting a range of strategies across 40 liquid contract months. Eurodollar is based on LIBOR as an underlying, and as part of the LIBOR transition will migrate to a new 3-month SOFR future. Previous analysis of the transition has focused on overall open interest and traded volumes on SOFR and Eurodollar across the entire product complex. However, the interactions and liquidity across the Eurodollar complex are complex and dynamic, meaning the transition to SOFR is not uniform across all contracts. In order to see how different parts of the Eurodollar complex have migrated to SOFR, we looked at BMLL data.

Looking back over the last 12 months, we see a clear difference between the profile of the transition in the swaps market compared to the futures market (Exhibit 1/Exhibit 2).

Exhibit 1: SOFR Daily Volumes by Month

Exhibit 2: SR3 Futures Daily Volumes by Month

While there was an accelerated migration to the use of SOFR in the swaps market in January and February 2022, in contrast, by the end of February 2022, only around 25% of future volumes had transitioned to SOFR.

However, the picture is even more complicated. Rather than looking at the Eurodollar futures complex in its entirety, we also analysed distinct packs and bundles. A pack consists of a strip of consecutive futures contracts that are often used for hedging interest rate swap exposures. For example, a 1-year pack (known as a white pack) might be used to hedge the floating rate of a 1-year interest rate swap.

To analyse liquidity across the two contracts, we considered two specific measures:

- What is the spread that is quoted?

- How much liquidity is quoted at different spreads?

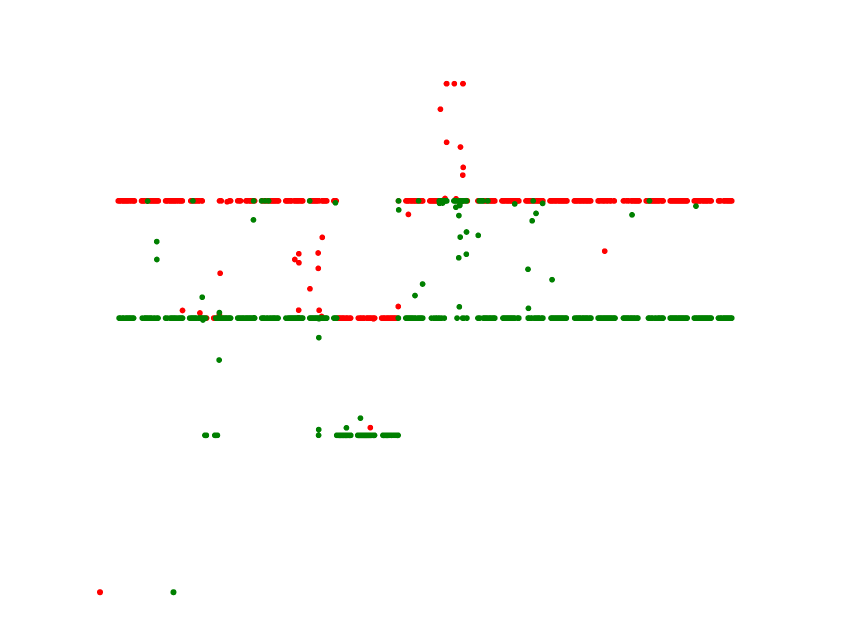

We looked before and after 14th March, which is the date that the March contract expired. Before and after the expiry date, we see a clear difference in the liquidity on the Eurodollar and SOFR packs. Before the roll date, the Eurodollar pack dominates with tighter spreads (Exhibit 3). After that date, there is a clear transition to the SOFR pack, which has tighter spreads and more liquidity at those tighter spreads (Exhibit 4).

Exhibit 3: 3-Month Eurodollar vs 3-Month SOFR Futures 1 year on 18-01-2022

Exhibit 4: 3-Month Eurodollar vs 3-Month SOFR Futures 2 year on 17-03-2022

Therefore, whilst the whole of the Eurodollar complex had not transitioned by this date, liquidity in certain packs had clearly transitioned.

Given the number of contracts in the complex and dynamic interactions between the individual contract months and packs and bundles, understanding how liquidity is changing between the two complexes is critical in helping market participants properly manage the LIBOR transition and to manage risk.

#2: SOFR-GE inter-product spread

A popular way of trading futures markets is through inter-market spread trades, where a future is bought on one product, and sold on a different product. Interest rate derivatives are no different, and there is a dedicated SOFR-Eurodollar spread market, which consists of buying a SOFR 3-month contract and selling a 3-month Eurodollar contract. With the LIBOR transitioning to SOFR by June 2023, this has some unique implications of the liquidity profile and pricing of these spread products.

As part of the migration to SOFR, from June 2023 all remaining Eurodollar contracts will migrate into SOFR futures, with a fixed rate between them (the “fallback rate”). The fallback rate to be used is the SOFR rate plus a fixed spread of +26.161 basis points (bps) for every contract from September 2023 and beyond. This effectively means that any contract currently trading that's based on “LIBOR”, will be equal to SOFR +26.161 bps for any expiry beyond June 2023. Beyond June 2023, the price of any SOFR-Eurodollar spread should therefore be exactly 26.161 bps. This gives us an unusual opportunity to analyse a spread market that has a fixed reference price.

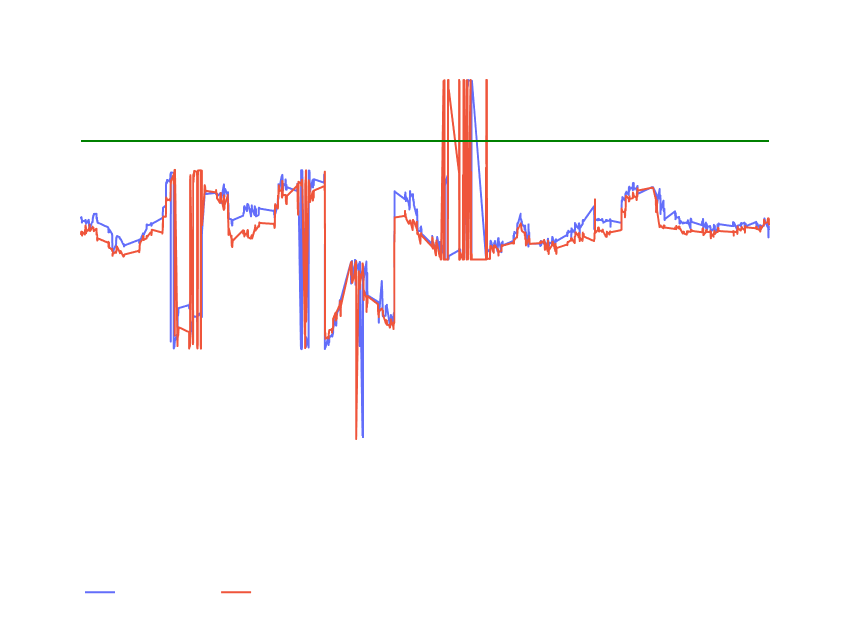

However, a look at the midpoint and traded prices of the spread product for September 2023 spread reveals a surprising result - the price is not at 26bps (the nearest tick that is available). Instead, it is consistently lower than that, and in the early part of 2022 was much lower than 26bps (going as low as 24.5) (Exhibit 1 / Exhibit 2). This suggests there was potentially an arbitrage opportunity, and leads to the question - why was the price of the spread product not closer to the “true” value?

Exhibit 1: Traded prices for SR3Z3-GEZ3

Description: When examining the December 2023 inter-commodity spread trades (SR3Z3-GEZ3), it is clear that whilst most trades execute between 25.5 - 26.16, there is some variation between January and May 2022.

Exhibit 2: Weighted Midpoint Weighted Midpoint for SR3U3-GEU3 and SR3Z3-GEZ3

Description: examining the weighted midpoint for the September (SR3U3-GEU3) and the December (SR3Z3-GEZ3) 2023 inter-commodity spread highlights the volatility of both contracts. However, from May 2022 onwards, the midpoint price stabilises.

The answer to this may be because of the initial margin that CME required on the spread. While there was an arbitrage, the returns were small relative to the margin participants would have to post on the trade. The margin requirements were changed at the start of June 2022, and you can clearly see the stabilisation of the price towards 26bps, although it is still slightly below, potentially due to selling pressure from other parts of the Eurodollar complex as part of the transition.

An in-depth understanding

Eurodollar and SOFR futures are critical product complexes, and so it is essential to understand the impact of the LIBOR transition. Over the next 18 months, firms need a detailed understanding of how liquidity changes across the complex can inform trading, execution and hedging.

BMLL’s product suite provides the tools and data that allow users to navigate this environment. BMLL can identify where liquidity transitions have taken place and can help traders and quants build strategies to generate alpha and achieve best execution.

From either a best-execution, trading, arbitrage or alpha-generation perspective, BMLL provides deep insights on the interest rate complex to help navigate through the LIBOR transition period.

To learn more about BMLL’s findings and analysis of the LIBOR transition, watch the webinar recording here:

Staying ahead of the curve: understanding the LIBOR transition through Level 3 Data.