BMLL Market Lens: The View from the Feed is created using data analytics from the BMLL Data Feed, an API feed containing 500 daily and intraday analytics derived from the full Level 3 order book.

Below is a selection of metrics used by BMLL clients to better understand the market. Contact us to discover how BMLL Data Feed analytics and market data can enhance your market insight.

Indices:

- Europe - Cboe UK100, Cboe CH20, Cboe DE40, Cboe FR40, Cboe IT40

- APAC - AU200, JP30, CN50, HK82

- Americas - Nasdaq US100

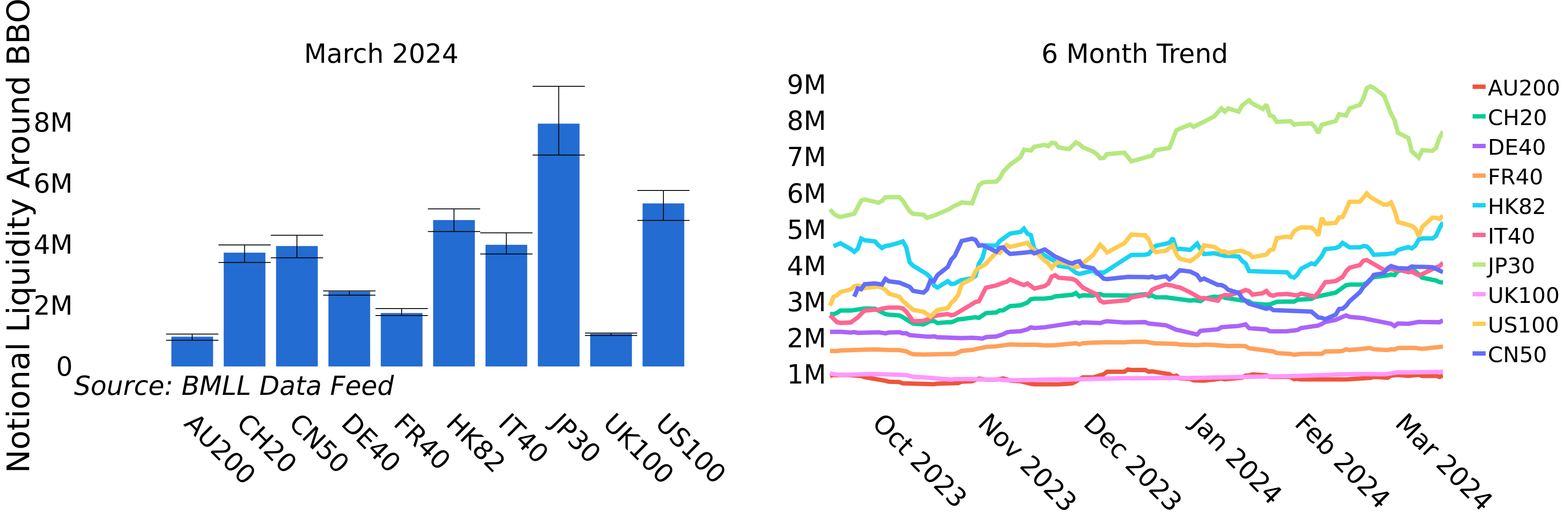

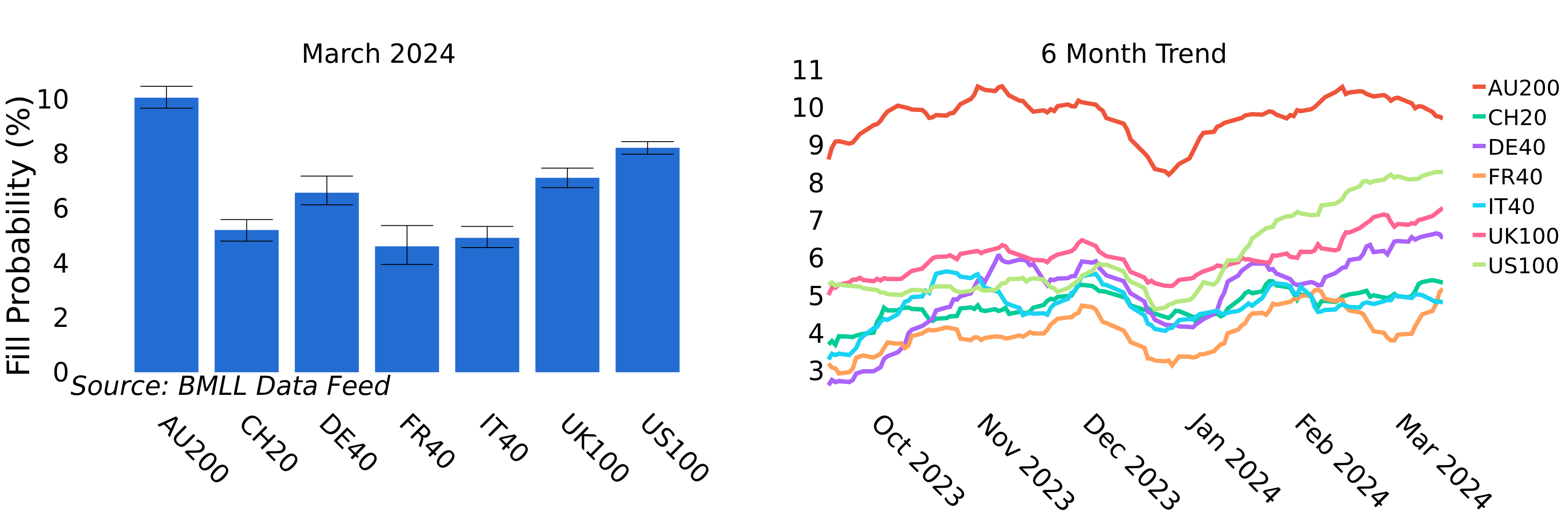

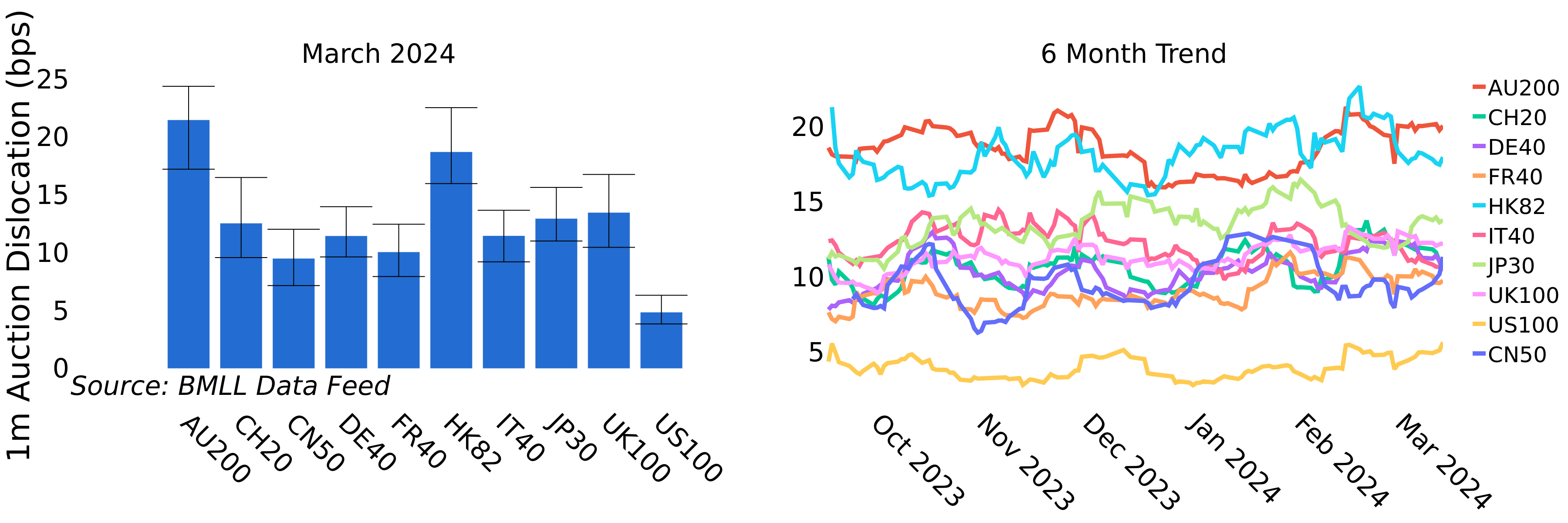

Across an index, the values are aggregated using a weighted mean of the considered metric with the lit trade notional of that listing and smoothed using a 10-day rolling average. The Notional Liquidity and Trade Notional has been converted to Euros from all other currencies. The conversion rate uses the daily rate published by the ECB. On each bar chart, the white whiskers span the 25th to the 75th percentile, also weighted by the lit trade notional, to show the distribution width.

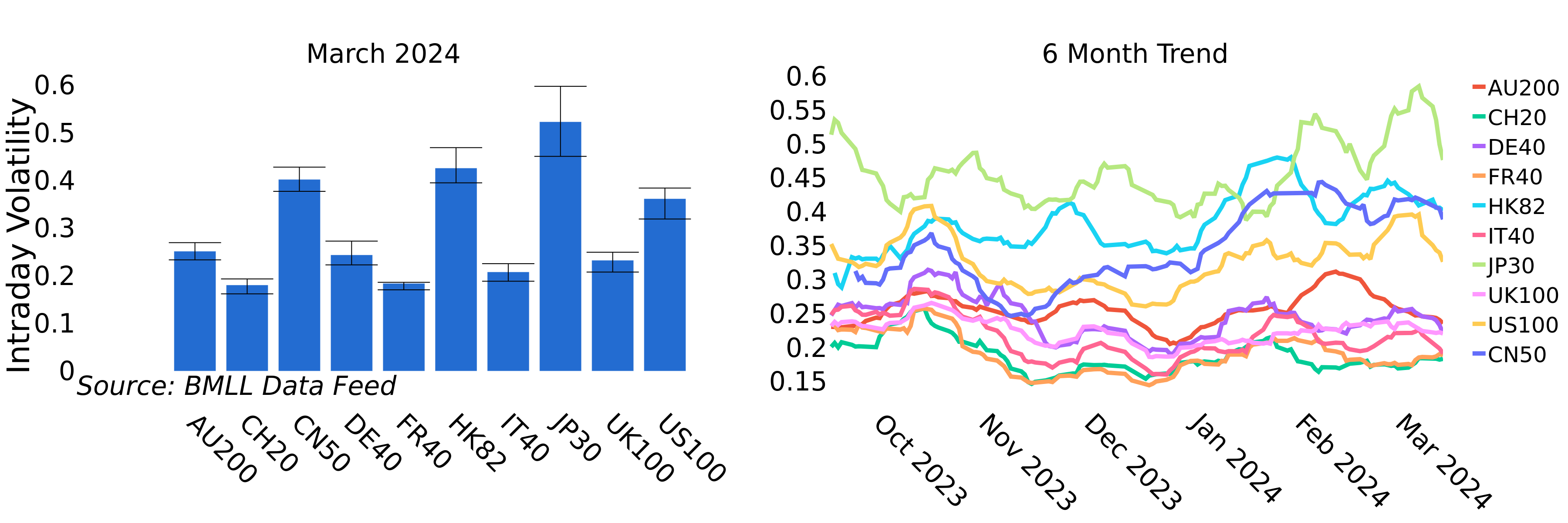

Volatility

The standard deviation of the log returns the mid-price of the lit order book on a venue during continuous trading, using a sampling frequency of 1 minute. The volatility is annualised, assuming a standard 8.5 hours in a trading day and 252 trading days in a year.

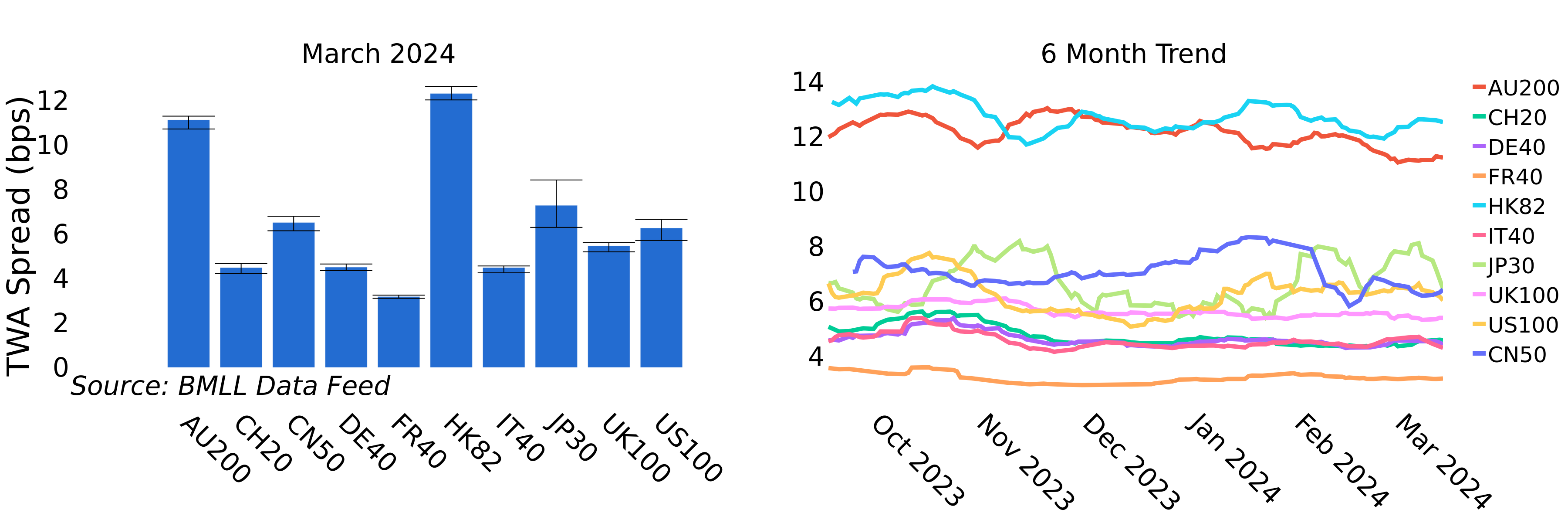

TWA Spread

The time weighted mean bid-ask spread of the day, given in basis points relation to the time-weighted mean mid-point price.

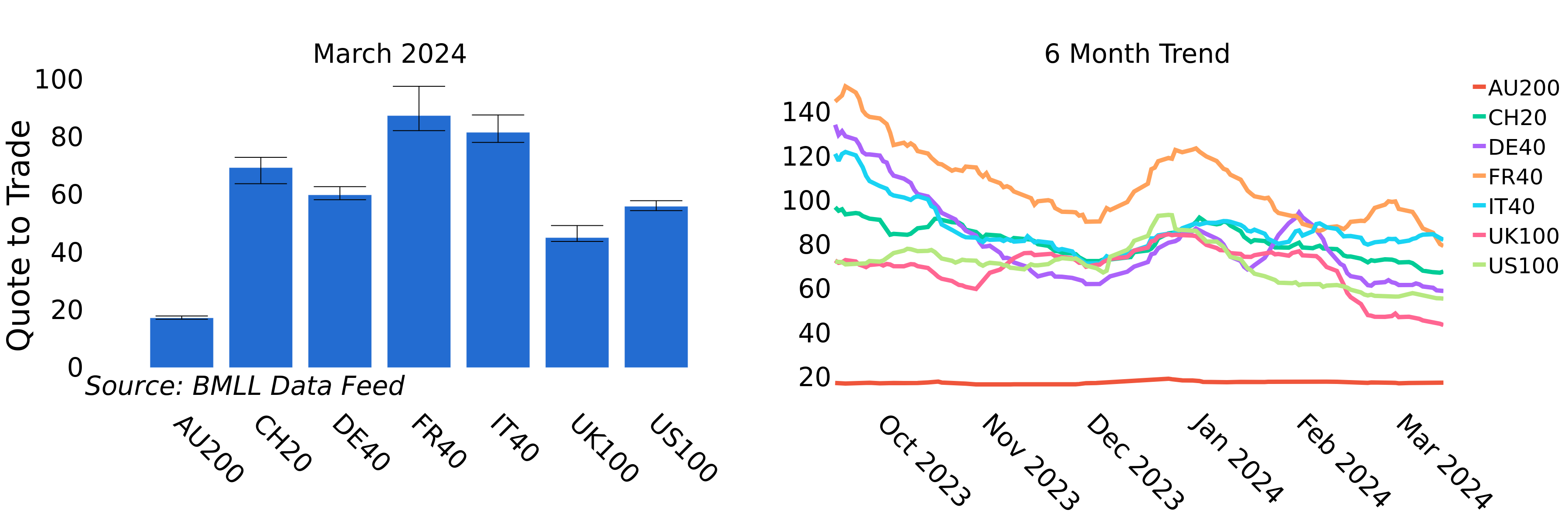

Quote to Trade

The ratio of quotes to trades. The number of quotes is calculated as the number of messages which did not signify an order execution. The number of trades is calculated as the number of aggressive executions, where simultaneous partial executions of a single order are counted as a single trade.

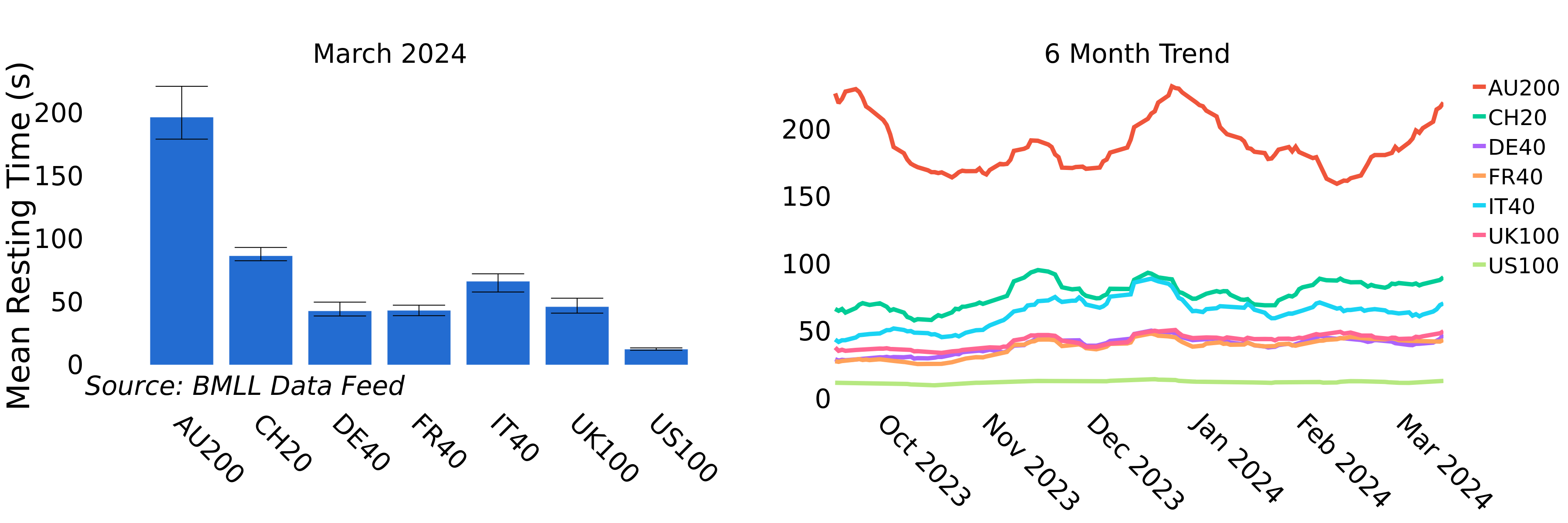

Mean Resting Time

The mean time, in seconds, that an order placed at the 1st level of the book will sit on the book before being totally or partially filled.

Liquidity

The time weighted average notional amount up to 30 basis points around the BBO.

Fill Probability

The probability that an order placed at the 1st level of the book will be filled within 60 seconds.

Auction Dislocation

The change (in basis points) between the mid-point price 1 minute prior to the end of continuous trading and the closing price of the auction on the Regulated Market.

Request access to the BMLL Data Feed analytics API or receive a BMLL Data Feed data sample.

More information on the BMLL Data Feed.

More Market Lens articles

BMLL Market Lens: European Liquidity Maps

BMLL Market Lens: US Liquidity Maps

Browse further Market Insight articles