On 20 September, the DAX30 became the DAX40. Ahead of this index rebalance, the market experienced a state change in anticipation of the demand for shares in the 10 securities added to the index. We see this clearly in the granular order book data. On 17 September, over €3.8 billion traded across European venues in these names marked a nearly 5 times increase over the 90-day average.

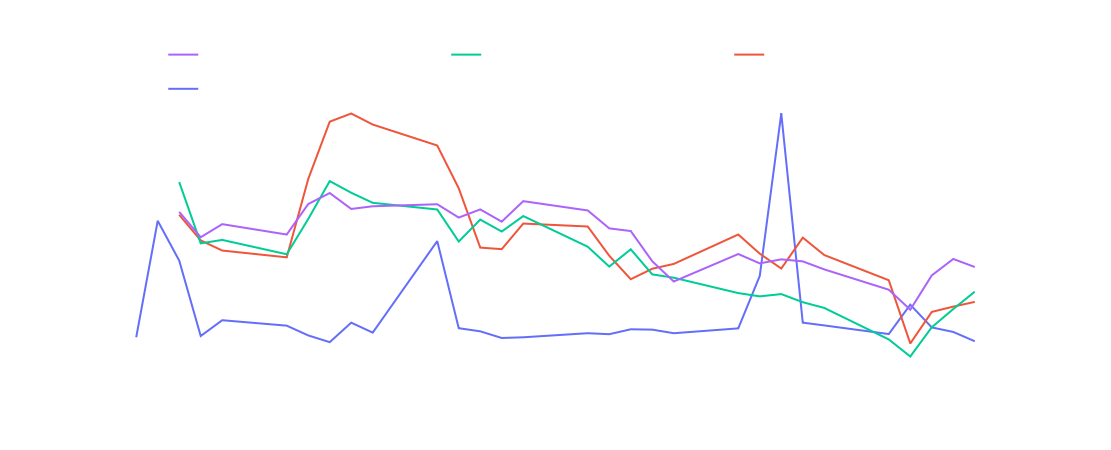

Notional Traded by liquidity classification for the 10 German Stocks constituting the DAX index rebalance (EUR Billions, 4 largest liquidity buckets only)

Traders routed 38.1% of the daily volume through the closing auction on the 17th marking a clear increase from the average of 10.6% of volume, indicating their preference to execute this index trade through this mechanism. Traders also routed their volumes through areas typically associated with minimising impact, such as OTC trading and non-addressable SI venues. Whilst Lit volumes increased 2.2 times up to €815 million, the continuous lit share fell from 29.7% (90-day average) to 14.0%. Further, there was no material change in market share of orders above LIS.

From 13 August, traders began to risk-off their passive strategies for fear of being adversely selected by this volume; this is seen through a 57% reduction in the mean resting time for passive orders placed at EBBO.

Mean Resting Time & Time Weighted Average Spreads for the 10 German Stocks constituting the DAX index rebalance

As the rebalance approaches, this effect continues to develop and the market state changes with thinner liquidity and increased market impact. From 10 September, this effect becomes sufficiently acute that traders pull back from the first level and we see the liquidity at touch begin to reduce to a maximum drop of 15.1%. From 14 September, around a week before the rebalance, we see liquidity within 10 basis points of BBO fall by 9.2% against the average. For those only looking at the top of the book, spreads began to widen from 13 September and peaked at 14 times baseline levels on 15 September.

When market states change, key parameters of trading performance such as spreads, market impact and volumes can experience large swings and offer insight beyond the top of the book. Only those who can observe the market state before these key parameters move can be proactive. Those without the most granular order book data will be forced to follow when the market moves and pay the price of doing so.

Methodology:

The 10 securities constituting the DAX index rebalance and this analysis: Airbus SE, Brenntag SE, HelloFresh SE, Qiagen N.V., Puma SE, Porsche Automobil Holding, Sartorius AG Vz, Siemens Healthineers AG, Symrise AG, Zalando SE